When stock options gave way to the popularity of Restricted Stock Units (RSUs), a whole new set of questions arose for executive participants in deferred compensation plans. Do I defer or not? What about vesting? Can I diversify into other investments? How will my decision impact tax liabilities?

Access the answers in our latest case study, “Deferring Restricted Stock Units in Your Company’s Deferred Compensation Plan.” Additionally, plan sponsors will learn our methodology for diversifying RSUs as a plan feature, while still maintaining P&L stability.

A Word on Diversification

It’s not uncommon for a DCP to permit the deferral of RSU’s. However, it’s rare for a plan to allow the diversification of RSUs into other investment options offered in the DCP. Typically, RSUs are not diversifiable and are paid out as shares upon distribution from the DCP. This allows the company to use favorable fixed accounting for the RSU liability, eliminating any potentially volatile impact on the P&L. Unfortunately, without the ability to diversify RSU’s while in a DCP account, many executives have been reluctant to defer for fear of having to hold company stock through a negative event.

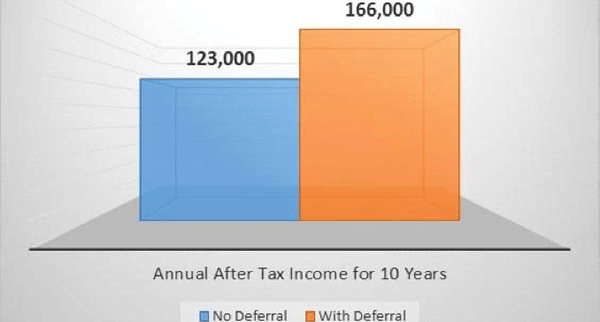

However, EBS has worked with plan sponsors to implement a methodology that permits diversification while still maintaining P&L stability. With diversification of RSUs as a plan feature, executives are more interested in taking advantage of the tax benefits of deferral because they retain the ability to sell RSUs that are held in their DCP account.

Contact us today to make an informed decision about tax implications related to RSU deferrals into your deferred compensation plan.

Bill MacDonald 760-340-4277

Chris Wyrtzen 617.904.9444 ext. 1

Managing Directors